Steps for Insurance Claims and Property Repairs

Table of Content

- How the Insurance Claim Check Process Works

- How do I cash a check made out to my mortgage company?

- Insurance Claims Process

- What Happens When Multiple Claim Checks Need to Be Issued?

- How to get a mortgage company to release your insurance check

- Most Underrated Add-Ons You Should Opt for With Your Motor Vehicle Insurance

The most common home insurance claims are related to weather events – but other claims are more unusual and can be downright bizarre. If you have a replacement cost insurance policy for your personal belongings, you typically must replace the items before your insurance carrier will reimburse you. Your insurer will likely suggest you document the damages and may schedule a claims adjuster to inspect your home.

If you are trying to cut costs and have the capability, use the settlement for materials and supplies, then perform the work yourself. For example, if a contractor falls through your skylight, his insurance pays for the replacement, but you fall through it, then you have to pay for the new skylight out of your own pocket. To get fully reimbursed for damaged items, most insurance companies will require you to purchase replacements. You'll generally have several months from the date of the cash value payment to purchase replacements; consult with your agent regarding the timeframe.

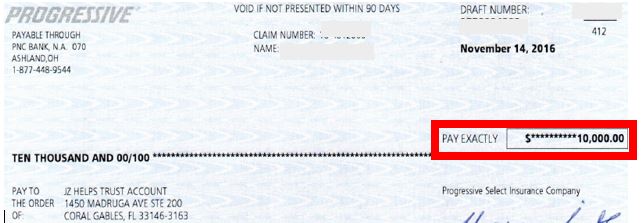

How the Insurance Claim Check Process Works

Beyond that, it helps to know how the home insurance claim check process works. When you get a mortgage, the lender is added to your homeowners insurance policy as mortgagee. This means that the insurance company will pay both you and the lender in the event of damage to the property. The lenders name and address is added to the policy in the section additional interest. The lender requires you to obtain a policy large enough to cover its loan amount so that it is fully protected from loss. Many mortgage lenders require borrowers to have a mortgagee payment clause on their homeowners insurance policies, which protects the lender in case of property damage.

The first one may be based on an estimate and will subtract your deductible amount while an additional check may be issued after the repair job is completed. It’s important to carefully read your policy and ensure you understand the terms and conditions before filing a claim. Ask your insurance agent if you are unclear about which weather-related events are covered and which are not. Trade logo displayed above belongs to ACKO Technology & Services Pvt Ltd and used by ACKO General insurance Limited under License. For more details on risk factors, terms, conditions and exclusions, please read the policy wordings carefully before concluding a sale. If the ex-showroom price of your vehicle was 10 lakhs, the IDV of your vehicle is now 8 lakhs.

How do I cash a check made out to my mortgage company?

In some cases, your lender may put the money from your insurance provider in an escrow account. In this situation, your lender will pay for work as it’s completed. You’ll likely need to show your mortgage lender your contractor’s bid in order to get upfront funds, and your lender may wish to inspect your home before making the final payment to the contractor.

Most usually go in for third-party insurance because its premiums are the lowest. This policy is also widely opted for due to the lack of awareness about other insurance policies, and how they can protect you in a wider variety of circumstances. Make a mortgage payment, get info on your escrow, submit an insurance claim, request a payoff quote or sign in to your account. Go to Chase home equity services to manage your home equity account. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible.

Insurance Claims Process

With just a few clicks you can look up the GEICO Insurance Agency partner your Business Owners Policy is with to find policy service options and contact information. Any entity or person who is a named insured on the policy for the damaged property. Each mortgage company has its own procedure, so be sure and find out from yours how it works. When your claim is finished, you will likely receive a notice that shows the total amount paid and that you accept the claim as closed. In most cases, a single claim should not cause your rate to rise, although certain types of claims — such as one for a dog bite — could quickly result in higher rates.

If your mortgage was originated in the past two decades, the security instrument known as the mortgage is likely to have similar language that is specific to insurance claims and property losses. On a $30,000 claim, for example, the first $10,000 would be given to the homeowner to pay the contractor when the claim is first documented, according to Northagen. The lender then pays for an inspection when the work is approximately 50 percent complete and releases the second installment if the inspection is satisfactory. The final payment is made after another inspection passes, ensuring that the repair is complete. "Typically, for a larger claim, the lender becomes more intimately involved with the repair process," he adds.

Her writing interests include “How to” guides across different insurance types as well as other educational pieces. Alison earned a BA in Communication and Media from Merrimack College in Massachusetts. Kyra Baker is a fact-checker with nearly 10 years of experience working and assisting on editorial projects within the culture, arts, and publishing spaces. For the past eight years, she has worked as a fact-checker at Art Papers Magazine, an Atlanta, Georgia-based art magazine. She leverages this experience for The Balance, fact checking content for accuracy across a variety of financial topics.

You can better understand what to expect by asking questions of your insurance provider during the claims process. It's also beneficial to know what you'll have to give to be compensated. A significant claim may be handled differently than a little theft or burglary, such as a disaster.

For starters, call your insurance company as soon as possible after the event to explain what happened. Also, make sure to take pictures and do any necessary repairs to prevent further damage. At Insure.com, we are committed to providing honest and reliable information so that you can make the best financial decisions for you and your family.

The third party could be another person, their property, or their vehicle. When it comes to motor vehicle insurance policies in India, there are two primary types. For all other policies, log in to your current Homeowners, Renters, or Condo policy to review your policy and contact a customer service agent to discuss your jewelry insurance options. Our experienced agents can help you with any paperwork and to manage your policy. As your mortgage servicer, we have financial interest in your home and need to make sure it’s restored to the condition it was in immediately before it was damaged. Our Insurance Claim Package walks you through the insurance process, provides the necessary forms you may need and serves as a roadmap to accessing the funds you need to repair your home.

If you read the fine print on your policy, you will be better prepared when disaster strikes. Take care to document all of the issues and get a professional to assess the damage before the insurance company makes their estimates. Once you've settled on an estimate, your insurance provider may make the claim check out to you, or someone else. When disaster strikes, such as a fire or burglary, you’ll want to file a homeowners insurance claim with your insurance provider. If your carrier approves the claim, your agent will write a check for the loss.

All of our content is written and reviewed by industry professionals and insurance experts. We maintain strict editorial independence from insurance companies to maintain our editorial integrity, so our recommendations are unbiased and are based on a comprehensive list of criteria. In India, the Motor Vehicles Act mandates that every vehicle in the country should have a valid motor insurance policy.

Comments

Post a Comment